Freelancing, blogging, or being an online entrepreneur are not uncommon terms nowadays. I, being a part of this community understand the pros and cons it brings to our life. Working for yourself, the freedom of choosing your clients/projects, choosing the working hours, and the option to work from anywhere are massive advantages of freelancing. This paradigm shift in the workplace is being largely driven by millennials.

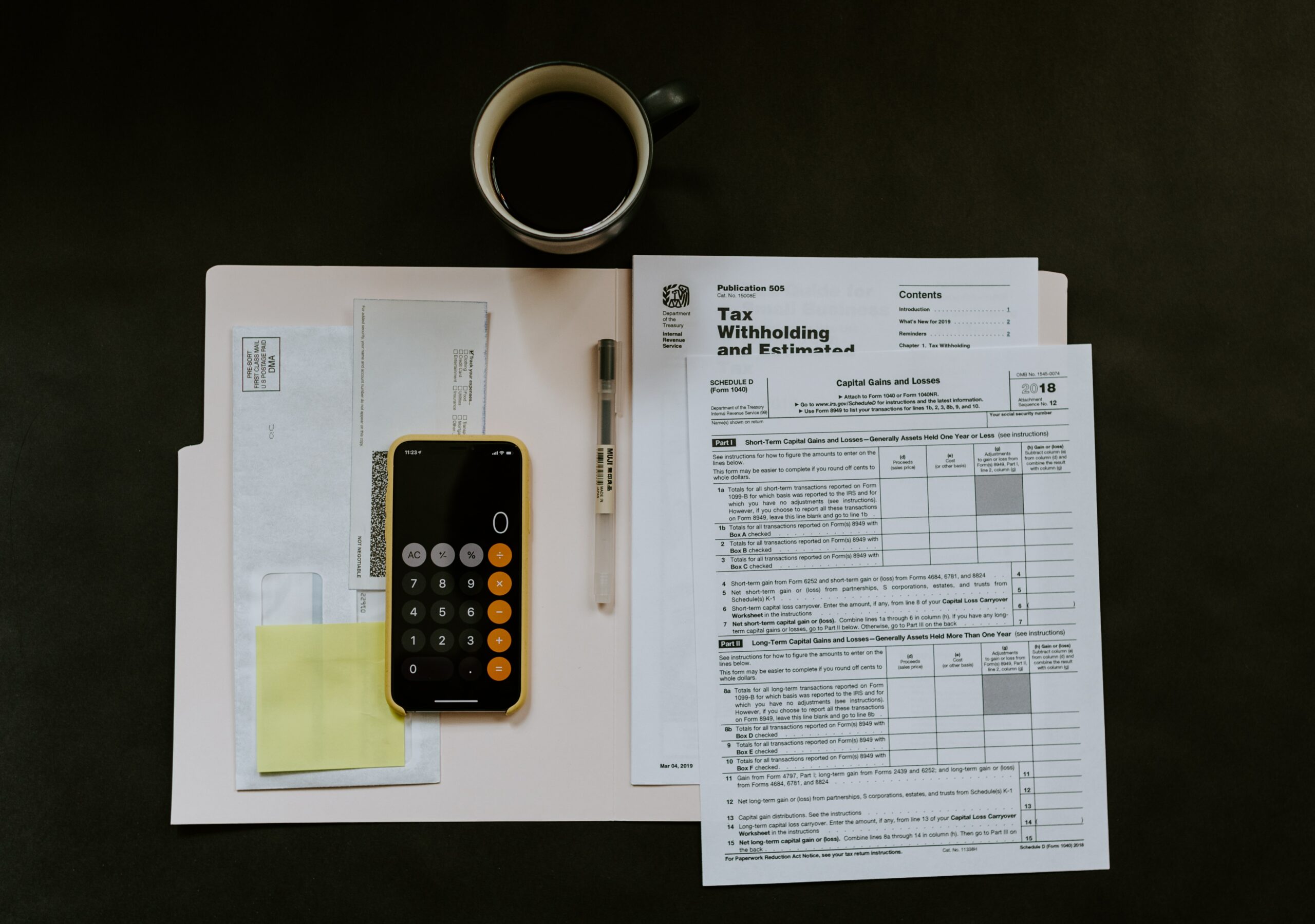

The term tax often brings sweat beads to our forehead. Especially when it comes to bloggers or freelancers in India, filing for tax becomes a dreaded topic, to say the least. Whether you’re someone who wants to sell their handmade items online, or you are a retailer of different goods who wants to add a digital channel, there are a few things that you need to know before you can take the step.

Freelancing and online businesses are growing industries around the world. Just like every salaried individual, freelancers are also accountable to pay taxes on their income. I understand it could get a little complicated for freelancers as at times they have multiple sources of revenue. With no employer taking taxes out of the paycheck every month, the burden of accounting for business taxes and remaining tax compliant is completely your responsibility.

What is considered as an income for online entrepreneurs?

The amount of money that one receives for his/her work constitutes income. It includes all the payments received from a domestic or an international source and bank account statements are used to calculate the income generated. Income tax laws in India state that any revenue generated by an individual by implementing their intellectual or manual skills is considered an income from a profession.

What is a Sales Tax?

The tax imposed on the sale and purchase of goods/services within the state is called Sales Tax. Different states have different sales tax laws for their states. If you’re an online seller trying to decide if you need to collect sales tax, first determine if your home state has a sales tax at all.

An online web-store or a business with an online presence (on any marketplace) is obliged to pay income tax. India has a complex sales tax framework which is levied at both the state and central level. Sales tax for goods sold within the state is taxed as Value Added Tax (VAT) and inter-state sale of goods is charged Central Sales Tax (CST).

It depends on the goods and services you offer via online businesses, one may be subject to payment of direct taxes which is income tax, indirect taxes which include, service and sales, customs, and excise et cetera.

The surge of online businesses and more opportunities for freelancers are happening around the globe. With online sales becoming more popular and common, more states are creating economic nexus laws.

If you liked reading this, then please do not forget to subscribe to our newsletter. Have you checked our parenting zone or Books Corner? Also, if you like my work, don’t forget to follow me on INSTAGRAM.